South Carolina Real Estate Records

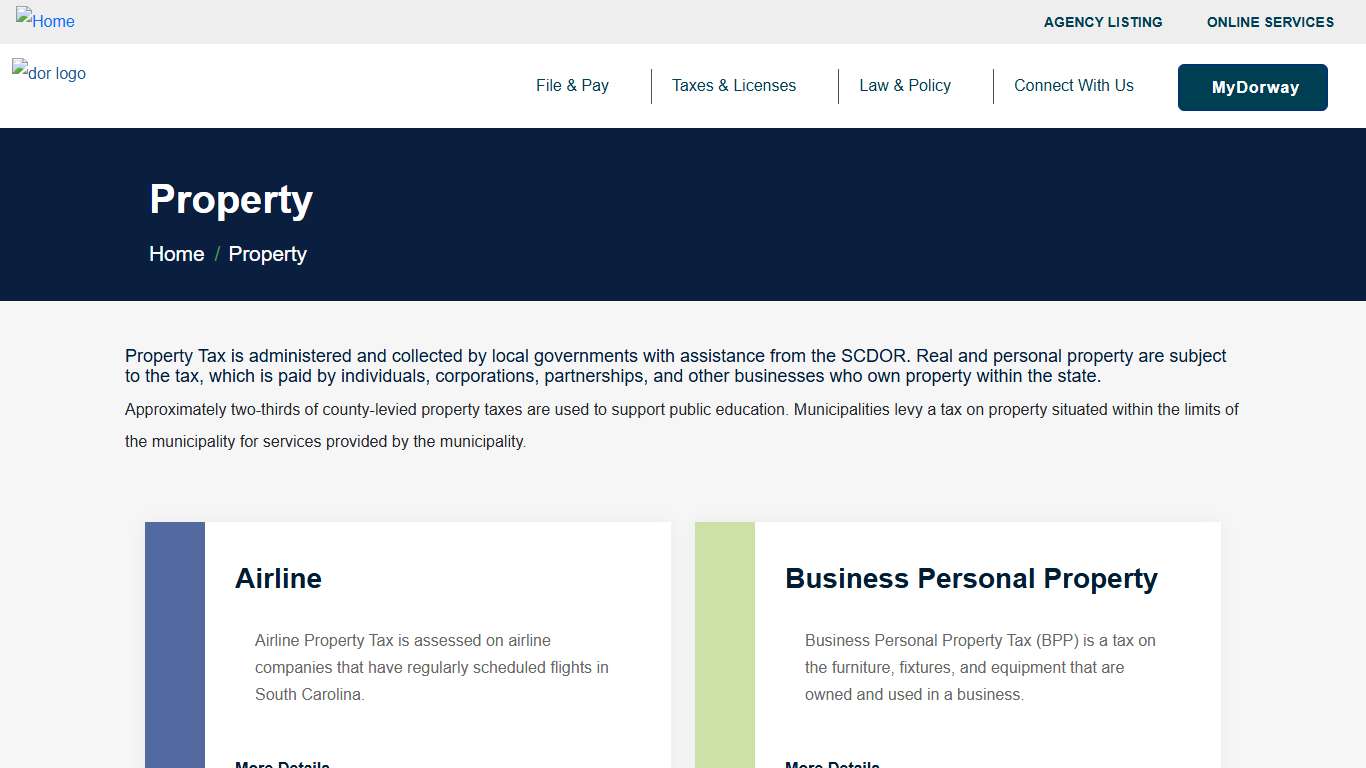

Property | South Carolina Department of Revenue

Property Tax is administered and collected by local governments with assistance from the SCDOR. Real and personal property are subject to the tax, which is paid by individuals, corporations, partnerships, and other businesses who own property within the state. Approximately two-thirds of county-levied property taxes are used to support public education. Municipalities levy a tax on property situated within the limits of the municipality for se...

https://dor.sc.gov/property

Register of Deeds Office | Charleston County Government

Responsibilities The Register of Deeds Office records land titles, liens and other documents related to property transactions in Charleston County. The ROD, an elected official, must assure that all recorded documents comply with the requirements of federal and state recording statutes and are available for public review.

https://www.charlestoncounty.org/departments/rod/index.php

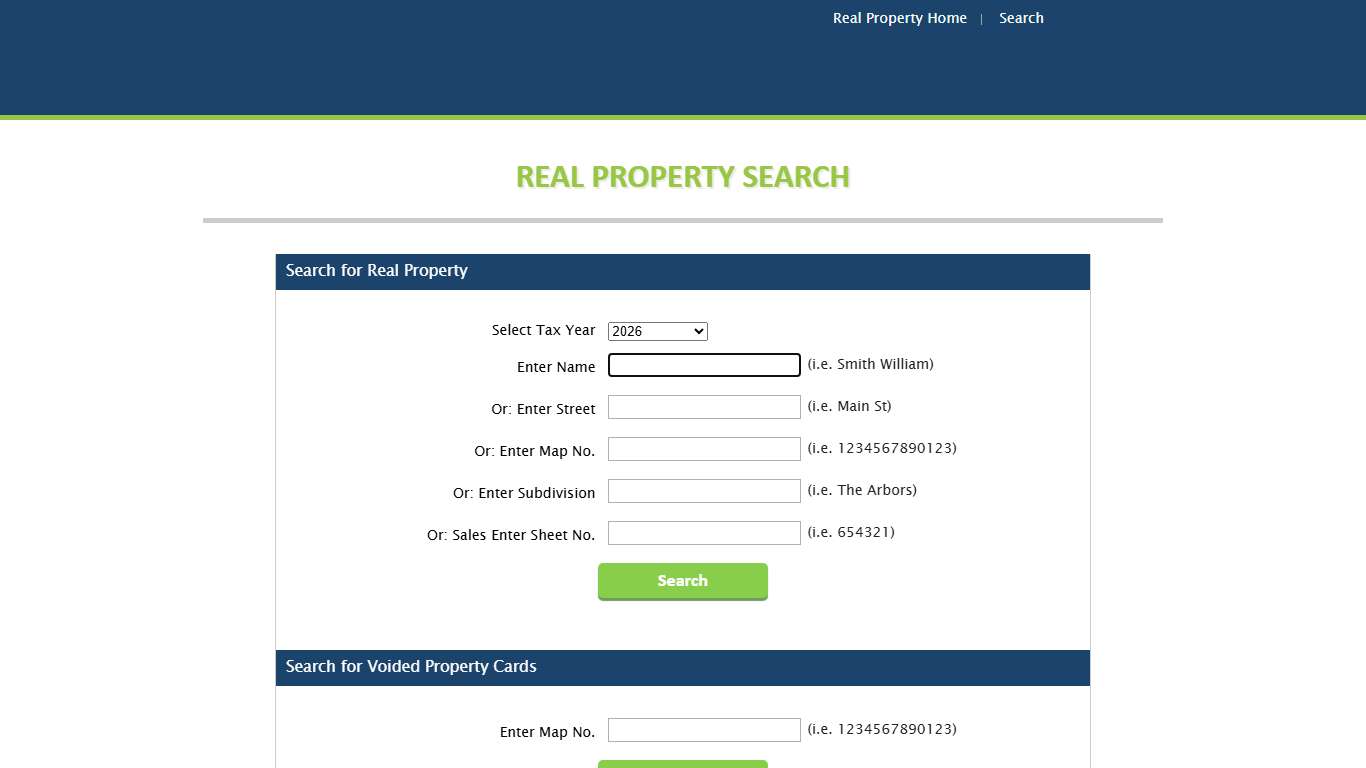

Real Property Services

Real Property Search. Search for Real Property. Select Tax Year. 1995, 1996 ... 2026, 3025, 8022, ALL. Enter Name, (i.e. Smith William). Or: Enter Street, (i.e. ...

https://www.greenvillecounty.org/appsas400/RealProperty/

Register of Deeds - Horry County SC.Gov

As the custodian of land records for Horry County, South Carolina, we are ... ©2026 by Horry County Government — All Rights Reserved. General Info info ...

https://www.horrycountysc.gov/departments/register-of-deeds/Deed, Mortgage or Miscellaneous Document Name/Date Search: Register of Deeds Office | Charleston County Government

Prior to February 29, 2024 – Church listings were put in as "Church" before the name of the Church. Also, denominations were put in first before other names. Examples: If searching a name that contains "Church of God" or "Church of Christ," first, search by: Effective March 01, 2024 – All Churches will be indexed straight across as is on recordings.

https://www.charlestoncounty.org/departments/rod/rodsearch.php

Important Changes to Know about in South Carolina for 2026 - The Floyd Law Firm PC

As 2026 approaches, residents of South Carolina can expect several important changes at both the state and federal levels. From tax updates and new withholding rules to adjustments in state budgets, DMV procedures, and business liability laws—the coming year will bring shifts that may affect families, workers, businesses, and property owners.

https://www.floydlaw.com/information/important-changes-to-know-about-in-south-carolina-for-2026/

Real Property Tax History

Tax History website provides 10 years of history. If more or other years of history are needed please contact the appropriate office. Search & Pay Taxes...

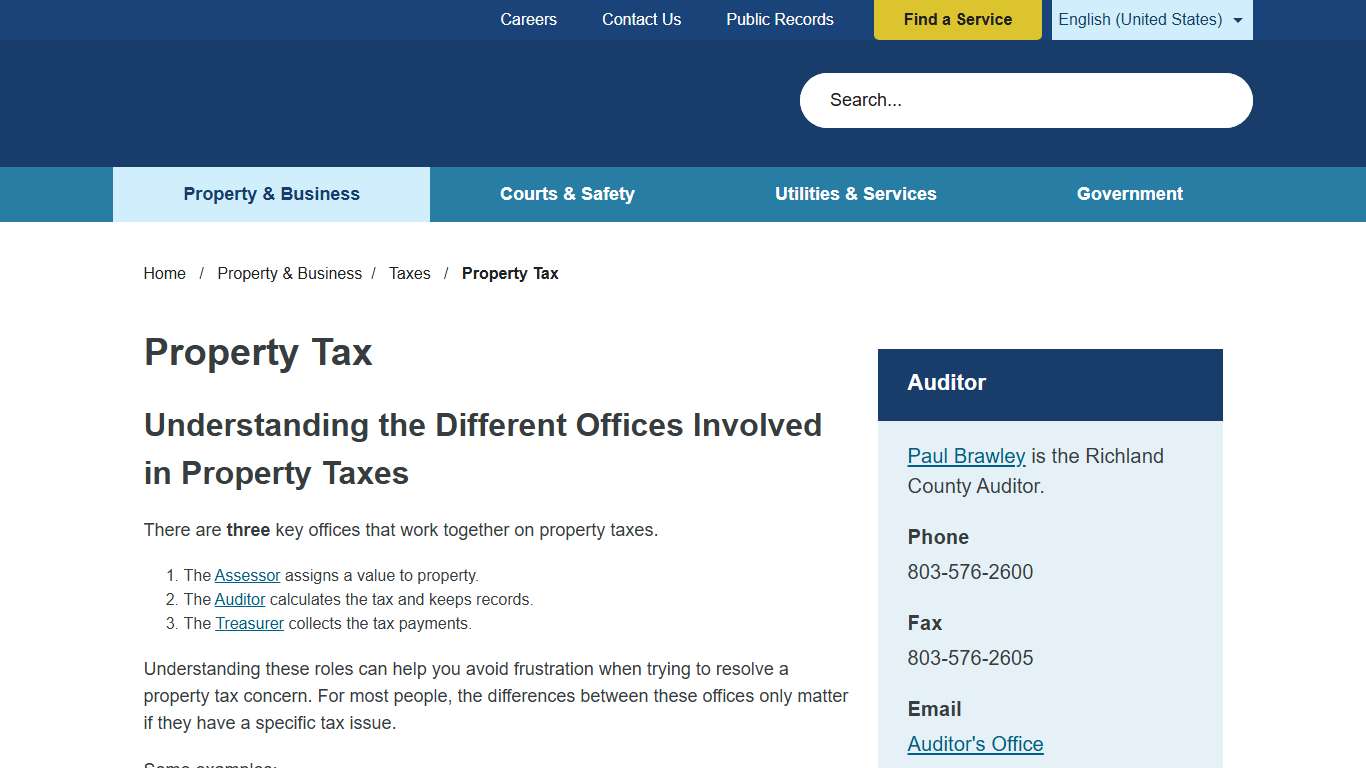

https://www.aikencountysc.gov/TaxHistoryProperty Tax | Richland County SC

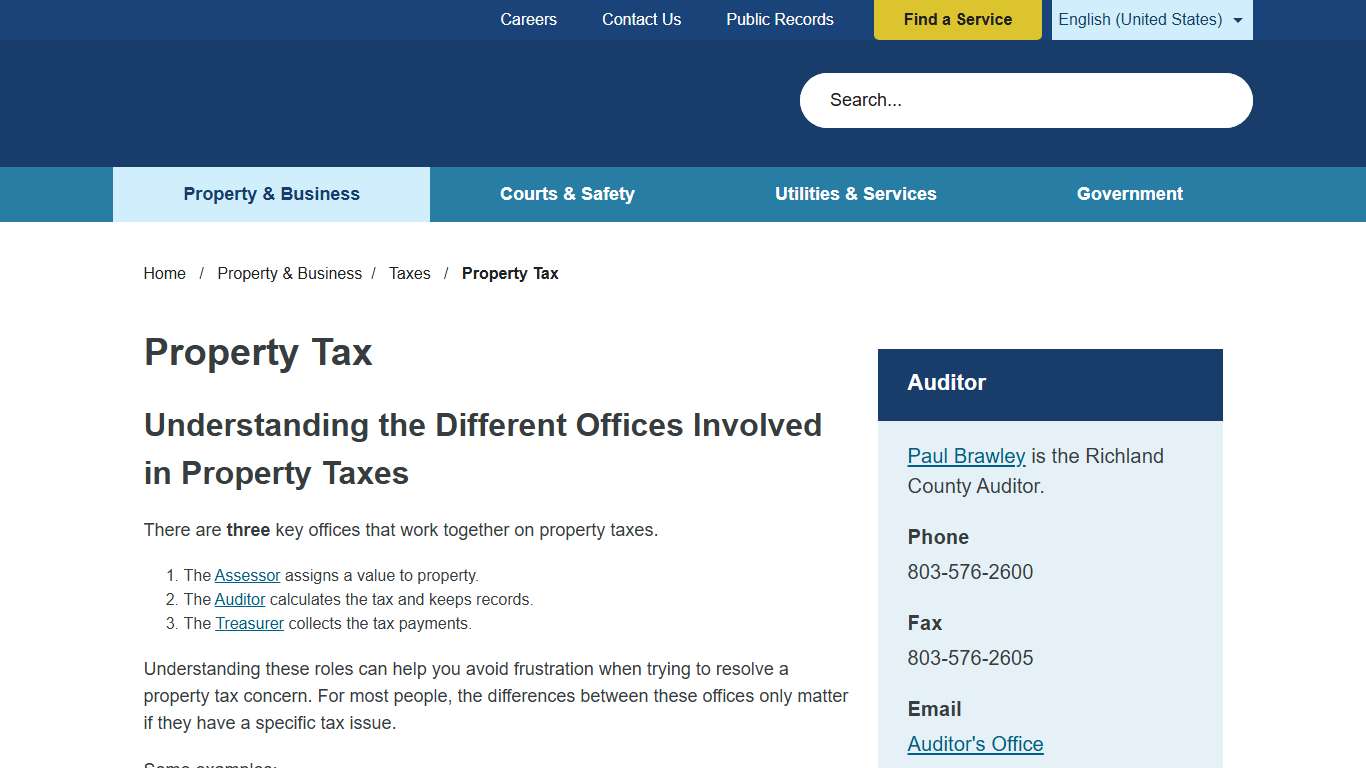

Learn how three key County offices work together and how to read the tax bill.

https://www.richlandcountysc.gov/Property-Business/Taxes/Property-Tax

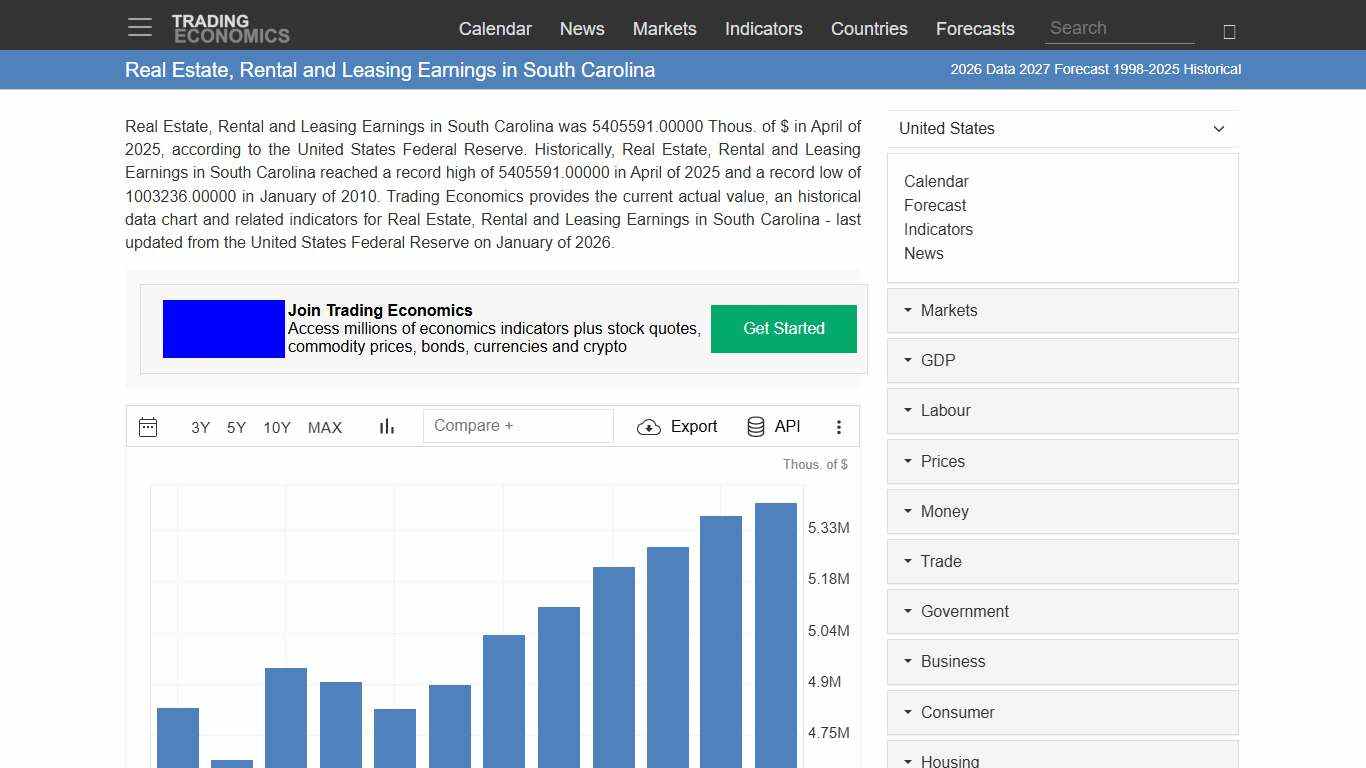

Real Estate, Rental and Leasing Earnings in South Carolina - 2026 Data 2027 Forecast 1998-2025 Historical

Real Estate, Rental and Leasing Earnings in South Carolina was 5405591.00000 Thous. of $ in April of 2025, according to the United States Federal Reserve. Historically, Real Estate, Rental and Leasing Earnings in South Carolina reached a record high of 5405591.00000 in April of 2025 and a record low of 1003236.00000 in January of 2010.

https://tradingeconomics.com/united-states/real-estate-rental-and-leasing-earnings-in-south-carolina-fed-data.html

Deed, Mortgage or Miscellaneous Document Name/Date Search: Register of Deeds Office | Charleston County Government

Prior to February 29, 2024 – Church listings were put in as "Church" before the name of the Church. Also, denominations were put in first before other names. Examples: If searching a name that contains "Church of God" or "Church of Christ," first, search by: Effective March 01, 2024 – All Churches will be indexed straight across as is on recordings.

https://www.charlestoncounty.org/departments/rod/rodsearch.php

South Carolina Real Estate Exam 2026 (100 Questions with Explained Answers) - YouTube

NaN / NaN In this video Transcript Description 309Likes 13,505Views 2024Sep 3 Transcript Follow along using the transcript. Show transcript Real Estate Advantage 54.2K subscribers Transcript Show more...

https://www.youtube.com/watch?v=X84jU4iGiDc

Cuts to property and income taxes for some SC residents advance in Senate • SC Daily Gazette

20:57 News Story Cuts to property and income taxes for some SC residents advance in Senate After the House passed a cut to the state’s income tax rate, senators came back with a proposal to reduce property taxes as well COLUMBIA — Income and property taxes could both go down for some South Carolina residents next year under dual bills advanced out of a Senate committee Tuesday.

https://scdailygazette.com/2026/01/20/cuts-to-property-and-income-taxes-for-some-sc-residents-advance-in-senate/

Bill tracking in South Carolina - H 4600 (2025-2026 legislative session) - FastDemocracy

- IntroducedDec 16, 2025 - Passed House - Passed Senate - Became Law A BILL TO AMEND THE SOUTH CAROLINA CODE OF LAWS BY AMENDING SECTION 12-37-220, RELATING TO PROPERTY TAX EXEMPTIONS, SO AS TO EXEMPT A CERTAIN PERCENT OF THE FAIR MARKET OF AN OWNER-OCCUPIED RESIDENTIAL PROPERTY IF THE OWNER IS A VETERAN WITH A SERVICE-CONNECTED DISABILITY.

https://fastdemocracy.com/bill-search/sc/2025-2026/bills/SCB00023672/

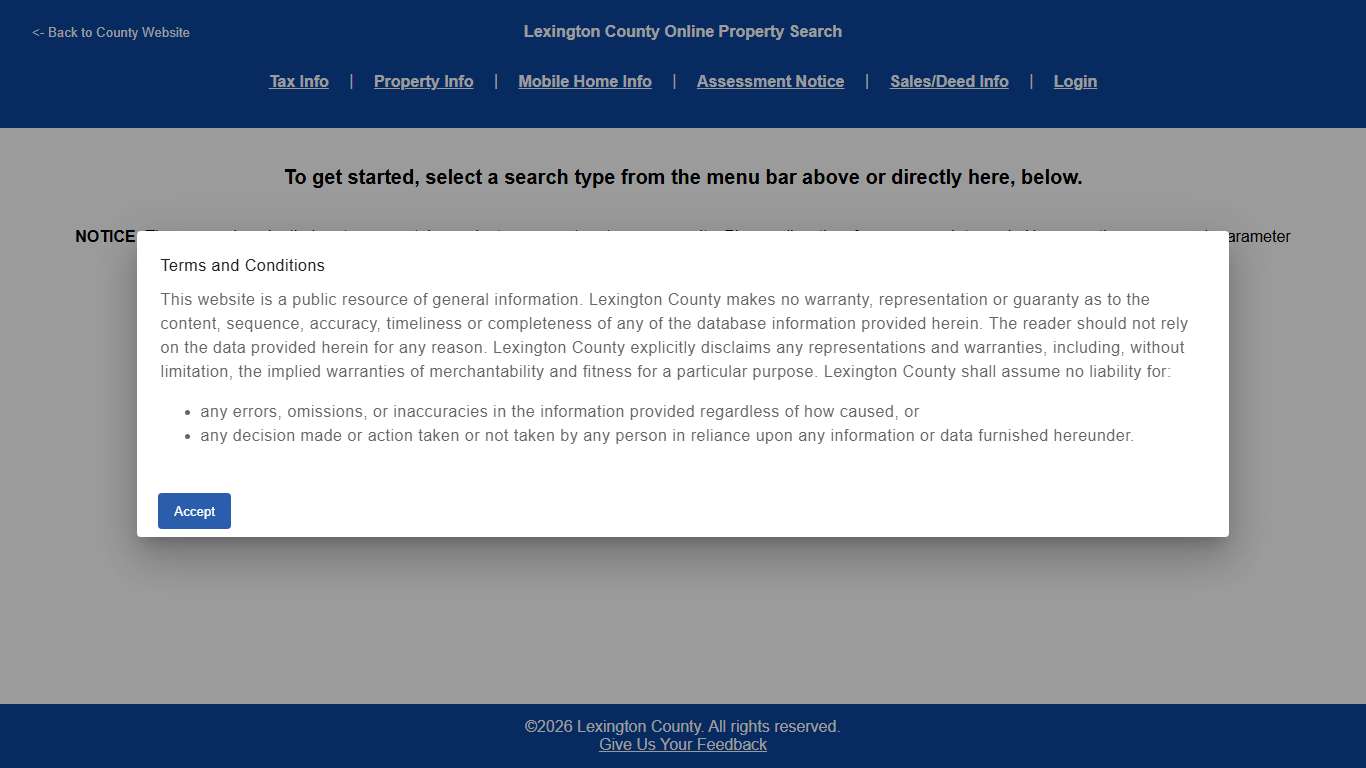

Property Search

To get started, select a search type from the menu bar above or directly here, below. NOTICE: These searches, by their nature, may take a minute or more to return any results. Please allow time for your search to work. Use more than one search parameter (if possible) to minimize the search time.

https://www.lex-co.com/PropSearch/

Property Tax | Richland County SC

Learn how three key County offices work together and how to read the tax bill.

https://www.richlandcountysc.gov/Property-Business/Taxes/Property-Tax